Gainful

Instant, easy solutions from anywhere. Apply with just one required document

Instant, easy solutions from anywhere. Apply with just one required document

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

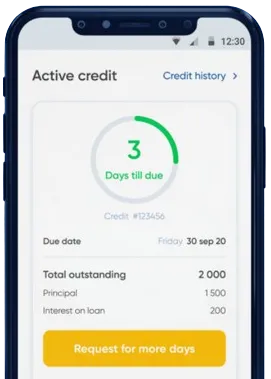

Easy, quick fixes from the comfort of your home. Instant transfer and loan extension opportunities

Make your request in the app, just complete the form.

Stand by for our decision, usually delivered in just 15 minutes.

Obtain your funds, usually taking only one minute to transfer.

Make your request in the app, just complete the form.

Download loan app

Payday loans have gained popularity in Nigeria as a quick and convenient way to access cash in times of financial emergencies. With the increasing cost of living and unpredictable economic situations, many people find themselves in need of urgent funds to cover unexpected expenses.

Payday loans provide a solution to this problem by offering short-term loans that are usually due on the borrower's next payday. These loans are typically easy to access and can be obtained within a short period, making them an attractive option for those in need of immediate financial assistance.

There are several benefits to taking out a payday loan in Nigeria. One of the main advantages is the speed at which the funds can be accessed. Unlike traditional bank loans that often involve a lengthy application process, payday loans can be approved and disbursed within a matter of hours.

Additionally, payday loans do not require a credit check, making them accessible to individuals with a poor credit history. This opens up opportunities for those who may have been turned down by traditional lenders to access the financial support they need.

These benefits make payday loans a useful option for those facing urgent financial needs or unexpected expenses.

Payday loans can be particularly useful in Nigeria where the majority of the population is employed in the informal sector. Many individuals in the country rely on daily or weekly income to support themselves and their families, making it difficult to access traditional bank loans that often require proof of regular income.

With payday loans, borrowers can access funds quickly and without the need for extensive documentation. This makes it easier for individuals in the informal sector to meet their financial obligations, whether it be paying bills, purchasing essentials, or covering medical expenses.

While payday loans can be a helpful financial tool, it is important to use them responsibly to avoid getting trapped in a cycle of debt. Borrowers should only take out payday loans for genuine emergencies and ensure that they can repay the loan on time to avoid incurring additional fees and charges.

By using payday loans responsibly, borrowers can benefit from the quick access to funds without falling into financial distress.

In conclusion, payday loans in Nigeria provide a valuable financial resource for individuals facing urgent financial needs. With quick access to funds, easy application processes, and flexible repayment terms, payday loans offer a convenient solution for those in need of immediate financial assistance. By using payday loans responsibly and understanding the terms and conditions, borrowers can benefit from the advantages that these loans provide.

A payday loan is a short-term, high-cost loan that is typically due on the borrower's next payday.

In Nigeria, borrowers can apply for payday loans online or in-person at various lending institutions. The borrower receives a sum of money which must be repaid, along with interest and fees, on their next payday.

Requirements may vary among lenders, but generally, borrowers must have a steady source of income, a valid bank account, and a form of identification to qualify for a payday loan in Nigeria.

Payday loans provide quick access to cash for emergency expenses, do not require a credit check, and can be obtained with minimal paperwork.

Payday loans often come with high interest rates and fees, which can make them expensive to repay. Borrowers who fail to repay on time may incur additional charges and harm their credit score.

Renewing or rolling over a payday loan in Nigeria is possible, but it can result in additional fees and interest, making the loan even more expensive in the long run. It is advisable to repay the loan on time to avoid these extra costs.